Market Analysis

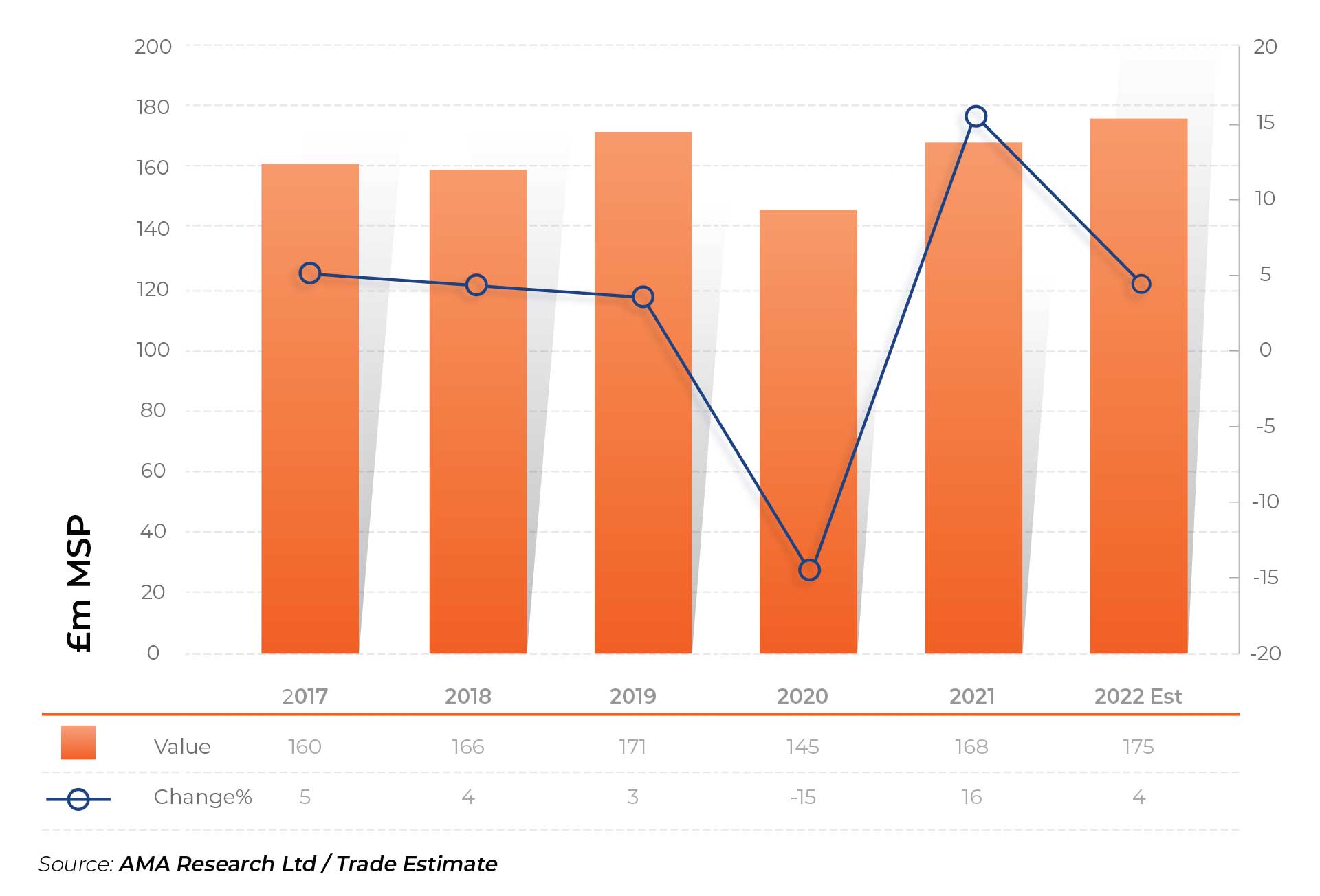

The UK residential and non-residential underfloor heating market has an estimated value of around £168 million at MSP in 2021.

The following chart illustrates the size of the UK underfloor heating (UFH) market since 2017, with an estimate for 2022

HYDRONIC IDEAS

Under floor heating

The UK underfloor heating market remains relatively fragmented, with the top 5 suppliers accounting for 58% of value sales of UFH systems in 2021.

The leading end-use application for underfloor heating is residential housing, with around 67% value share. This includes new build and retrofit installations in private homes (including self-build housing) and social properties.

End-use applications in the non-residential sector include schools, hospitals, commercial offices, and publicly owned buildings such as art galleries and museums. 14 © AMA Research, 2000 – 2025 Around 60% of the UK underfloor heating market is supplied directly, with several manufacturers and other specialists offering a ‘design, supply and fit’ service.

The remaining 40% of customers are supplied via merchants and other distributors such as the home improvement multiples and online retailers. Underfloor heating systems are also increasingly included in the products offered by companies such as tile manufacturers and kitchen & bathroom specialists.

Imports of underfloor heating remain high. However, the current weakness of Sterling has driven up costs for both own-label goods and branded imports. Many manufacturers now source components from abroad, although a full assembly of underfloor heating kits may occur within their facility.

HYDRONIC IDEAS

Under floor heating

The UK underfloor heating market remains relatively fragmented, with the top 5 suppliers accounting for 58% of value sales of UFH systems in 2021.

The leading end-use application for underfloor heating is residential housing, with around 67% value share. This includes new build and retrofit installations in private homes (including self-build housing) and social properties.

End-use applications in the non-residential sector include schools, hospitals, commercial offices, and publicly owned buildings such as art galleries and museums. 14 © AMA Research, 2000 – 2025 Around 60% of the UK underfloor heating market is supplied directly, with several manufacturers and other specialists offering a ‘design, supply and fit’ service.

The remaining 40% of customers are supplied via merchants and other distributors such as the home improvement multiples and online retailers. Underfloor heating systems are also increasingly included in the products offered by companies such as tile manufacturers and kitchen & bathroom specialists.

Imports of underfloor heating remain high. However, the current weakness of Sterling has driven up costs for both own-label goods and branded imports. Many manufacturers now source components from abroad, although a full assembly of underfloor heating kits may occur within their facility.

The UK underfloor heating market remains relatively fragmented, with the top 5 suppliers accounting for 58% of value sales of UFH systems in 2021.

The leading end-use application for underfloor heating is residential housing, with around 67% value share. This includes new build and retrofit installations in private homes (including self-build housing) and social properties.

End-use applications in the non-residential sector include schools, hospitals, commercial offices, and publicly owned buildings such as art galleries and museums. 14 © AMA Research, 2000 – 2025 Around 60% of the UK underfloor heating market is supplied directly, with several manufacturers and other specialists offering a ‘design, supply and fit’ service.

The remaining 40% of customers are supplied via merchants and other distributors such as the home improvement multiples and online retailers. Underfloor heating systems are also increasingly included in the products offered by companies such as tile manufacturers and kitchen & bathroom specialists.

Imports of underfloor heating remain high. However, the current weakness of Sterling has driven up costs for both own-label goods and branded imports. Many manufacturers now source components from abroad, although a full assembly of underfloor heating kits may occur within their facility.